The Foundation of Compassion & Community Support

Fulfill your Zakat obligations with United Muslims. Browse through our individual Zakat applicable projects or donate Zakat to where most needed. Use our Zakat calculator to pay Zakat Online.

The Essence of Zakat

Zakat, the third pillar of Islam is not just a charitable gesture, it is an obligatory act of service towards humanity. Every financially stable Muslim is obligated by Allah Almighty to donate a fixed proportion of one’s wealth to the needy brothers and sisters. This act not only purifies wealth but also supports the socio-economic welfare of Muslim Ummah.

The Impact of Zakat

We as a Muslim Ummah take pride in fulfilling our Zakat obligation which embodies the principles of compassion, shared prosperity and social responsibility. Zakat offers a beautiful mechanism and a structured approach to circulate wealth in the entire society. Your regular Zakat donations not only offer immediate financial assistance to the most needy but it also helps mitigate poverty and foster opportunities for growth and stability. Donate your Zakat online and help us help others.

Zakat

The Essence and Application of Zakat

Zakat, the third pillar of Islam is a way to cleanse one’s wealth and soul from greed and selfishness. Zakat is what makes us one Ummah, united in happiness and despair. It serves multiple purposes in a form of worship, as a method of cleansing one’s wealth, and a way of supporting the less fortunate. Indeed, Allah is the best of planners and Islamic teachings are the profound picture of brotherhood, solidarity, and equality.

At United Muslims, most of our projects are Zakat applicable. We have made it easy for you to pay your Zakat online to one of these projects or towards our Zakat fund. Each penny collected in our Zakat fund is spent cautiously towards the initiatives that have been helping millions around the world get access to food, clean water, livelihood and education. Zakat donations are the foundation of everything we do at United Muslims.

We have also developed an easy to use Zakat Calculator that gives an accurate calculation of the due amount so you can pay Zakat online. According to the Islamic law, Nisab (minimum amount of wealth) is the threshold that one must hold before being liable to pay Zakat. Nisab ensures that the Zakat obligation falls only upon those Muslims who can afford it and spares those who do not have means to pay it.

According to most scholars’ agreeable value, the Nisab threshold is the value of 87.48 grams of gold or 612.36 grams of silver. Our Zakat calculator offers easy calculation of the Zakat amount owed on the surplus of gold and silver held over one lunar year at current rates. Typically, Zakat is calculated at 2.5% of one’s surplus wealth and assets and our calculator is based on the same denominators.

Each year, the Zakat donations collected by United Muslims are distributed among the neediest. Our Zakat applicable projects such as Orphan Sponsorship Program, Education and Clean Water have been running on the generous Zakat donations. We also distribute Zakat funds to the Muslims struck by war, conflicts and natural disasters by offering them food, water, clothing and shelter. Fulfilling Zakat obligation promotes a cycle of kindness and generosity, reinforcing the bonds between Muslim Ummah.

Those who believe in Allah and the Last Day, establish regular prayers, pay their zakat, and fear none (but for Allah) will visit and preserve Allah’s mosques.

United Muslims Zakat Foundation has dedicated itself to assisting Muslims in the UK, USA, and around the world in fulfilling their Zakat duty every year. Our online donation forms are a quick and easy form of submitting Zakat donations online. We have also compiled a series of questions and answers to address the most common concerns of Zakat donors. Your Zakat donations are a catalyst for positive change and everlasting impact.

Support United Muslims: Give your Zakat to us with 100% of your donations directly funding our initiatives.

Since its founding, United Muslims has ensured every donation goes to its projects, covering any credit card fees. For example, if a $100 donation drops to $97 due to fees, the organization adds $3. This strict separation of project and operational funds ensures full public donation utilization.

BACKERS

Every Donation Ignites Hope

EA

June 25, 2025

Amount Donated

$190.00

MZ

June 1, 2025

Amount Donated

£140.00

ZA

May 31, 2025

Amount Donated

£72.40

MI

May 31, 2025

Amount Donated

$10.61

Managing Your Zakat Contributions

At United Muslims, a significant portion of our programs and appeals are Zakat applicable. Our dedicated Zakat fund is focused on providing life essentials to the most impoverished however, we also engage in sustainable projects that help break the cycle of poverty and empower communities.

Palestine Emergency

More than 33,000 lives lost and 1.7 million crammed into a space equivalent to one-quarter the size of London, lacking food, water, and basic healthcare. Donate for Palestine and support our team in delivering food, water, medical assistance and other essential winter kits to families who have been displaced.

Afghanistan Emergency

Severe drought, economic downturn, and escalating global food costs have driven millions in Afghanistan to the edge of starvation. Lives are in jeopardy, particularly as children suffer and perish from malnutrition. Your support is crucial to aid civilians, who have endured more than five decades of strife.

Clean Water

Providing wells, pumps, and pipes to communities in need. The lack of clean water is one of the most critical health emergencies affecting Muslim communities globally. Become a monthly donor and embark on a transformative journey to make a significant difference.

Sponsor a Child

Every child should have an ideal beginning: a nurturing environment, a secure space to play, and opportunities for education and healthcare. With immense rewards promised to Muslims who sponsor children/orphans in need. Be the change with United Muslims children response appeal.

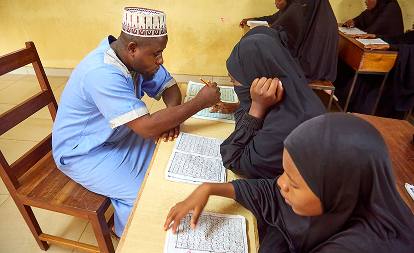

Education

Literacy, Numeracy & Health Classes. Millions of children trapped in poverty miss out on education, perpetuating a cycle of limited income opportunities. Breaking this cycle through basic education unlocks numerous life opportunities. At United Muslims, we are the charity for education.

NEED HELP

Questions? Ask!

We at United Muslims are expert in calculating Zakat for entrepreneurs & others who need help in understanding their Zakat obligations and ensuring that your charitable giving is both Sharia-compliant and tailored to the unique financial situations of your business. Fill in the form below and we will be in touch!

Who we are

Make a Difference

100% Donation Policy

You contributions directly support those in need, not overhead costs, maximizing your donations.

Tax Deductible

As a 501 (c) (3), your donations to us are tax-deductible, lowering your taxable income and overall tax liability.

Empowering

Spreading compassion in over 24 nations, we aim to end peoples’ dependency on aid.

Transparency & Trust

We maintain a clear policy regarding how donations are used, building trust and accountability.

Zakat FAQS

What is Zakat?

Zakat, the fourth pillar of Islam refers to a mandatory annual contribution made by an adult and financially able Muslim whose wealth surpasses the Nisab threshold for an entire Islamic year. It is a religious duty carried out by all Muslims to seek Allah’s (SWT) favor and help those in need.

Who is eligible for Zakat?

Unlike Sadaqah or Lillah, Zakat donations have specific eligibility criteria. For instance, a husband cannot allocate his Zakat to his wife or children, as he already bears financial responsibility for them. Conversely, a wife may give Zakat to her husband if he fulfills the necessary criteria, ensuring that she derives no direct benefit from this contribution, such as the husband using it to buy her a gift.

Recipients of Zakat fall into one of the following eight categories:

- The impoverished

- The destitute

- Zakat administrators, like United Muslims

- Those seeking to reconcile hearts

- Individuals in bondage or captivity

- Those burdened with debt

- Causes in the path of Allah

- Travelers in need

At United Muslims, we have a range of Zakat applicable projects that adhere to Islamic principles for the distribution of funds.

What is Nisab?

Nisab is the minimum amount of wealth a Muslim must possess for an entire lunar year to be obliged to pay Zakat. This threshold is based on the value of either gold or silver:

Gold: The value equivalent to 87.48 grams of gold.

Silver: The value equivalent to 612.36 grams of silver.

Since gold and silver prices fluctuate, the Nisab threshold varies accordingly. We have built a simple to use Zakat calculator that not only determines the eligibility but also calculates the amount due.

If your wealth falls below the Nisab threshold at any point during the Islamic year but remains above it at both the beginning and end of the year, it’s advisable to consult your local imam for guidance.

When should I pay Zakat?

Your obligation to pay Zakat arises when your wealth surpasses the Nisab threshold for an entire Islamic year, starting from the time your wealth initially exceeded this limit. The amount of Zakat due should be computed on the day you make your payment. Therefore, your Zakat is based on your current wealth status at the time of payment, regardless of any fluctuations in your wealth throughout the year.

The month of Ramadan is a favored period for many Muslims to fulfill their Zakat, as donations during this sacred month are believed to bring increased blessings and rewards. However, you are free to pay Zakat at any point in the year, provided your wealth has been above the Nisab threshold for a complete lunar year. It’s important to differentiate this from Zakat al Fitr, or Fitrana, which is a separate obligatory charity that must be paid before the Eid prayers during Ramadan.

Ramadan is a very favorable month amongst Muslims to fulfill their Zakat obligations however you are free to pay Zakat at any point during the year. We have a range of Zakat applicable projects that run throughout the year and help the neediest people around the world.

How much Zakat do I need to pay?

Your Zakat liability is determined by the following rates:

- 2.5% on personal wealth and yearly savings.

- 5% on the assets of a farmer who has paid for crop irrigation.

- 10% on the assets of a farmer whose crops have been naturally irrigated by rainfall.

- 20% on valuable resources found on one’s property, like gold, silver, and oil.

What assets should be considered for Zakat calculation?

Your Zakat obligation is based on your accumulated wealth, that includes personal assets and liquid funds. Zakat is due on assets that are not essential for your daily living. For example, your primary residence is exempt, but a secondary property that you don’t live in should be counted in your Zakat calculation. Similarly, while your primary vehicle is considered a necessity and exempt, a second car, deemed a luxury, should be included.

Assets to consider for Zakat calculation include:

- Cash, whether kept at home, in banks, or in savings accounts.

- Savings set aside for specific purposes (like Hajj, property deposits, weddings, etc.).

- The current value of any gold and silver you own.

- Stocks and shares in your possession.

- Revenue from rental properties (like a second home).

- The value of debts owed to you that you expect to be repaid (e.g., money lent to friends or relatives).

When calculating Zakat, do not take into account:

- Payments scheduled for the month in which you are paying Zakat.

- Debts you owe, such as mortgage/rent payments, credit card debts, and personal loans.

- Possessions like household appliances and clothing.

- Business-related expenses, including bills, salaries, rents, and rates.

- Business loans and overdrafts.

Is it permissible to settle Zakat in instalments?

You have the option to fulfil your Zakat obligation through instalment payments, although it is preferable to make a single lump-sum contribution. If you are confident that your wealth will remain consistent, you can choose to pay in advance of the due date.

How is Zakat-Ul-Fitr (Fitrana) different to Zakat?

Zakat al Fitr, also known as Fitrana, is a distinct contribution separate from Zakat. It is exclusively observed during the sacred month of Ramadan, prior to the commencement of Eid. Traditionally, Fitrana is presented in the form of food, but United Muslims also welcomes monetary contributions, valued at £4 per person in the UK. These funds are directed towards providing essential food assistance to those in dire need.

How do you calculate your Zakat?

We have an easy-to-use Zakat calculator on our website to effortlessly calculate your eligibility and the amount due.

How do I donate my Zakat?

After calculating your Zakat or knowing your owed amount, you have the option to make your donation through United Muslims. We have a range of Zakat applicable projects that you can pick from or just donate towards our ‘where most needed’ fund that helps the neediest.

Do you pay Zakat on property?

Residential property used for personal purposes is excluded from Zakat obligations.

Is it permissible to donate Zakat to charitable organizations?

You can authorize a charitable organization like United Muslims to distribute your Zakat to deserving recipients on your behalf, and it is permissible to do so.

Become a volunteer