Appeal – Save Lives Today

HOW WE HELP

Provide a future rich in opportunities

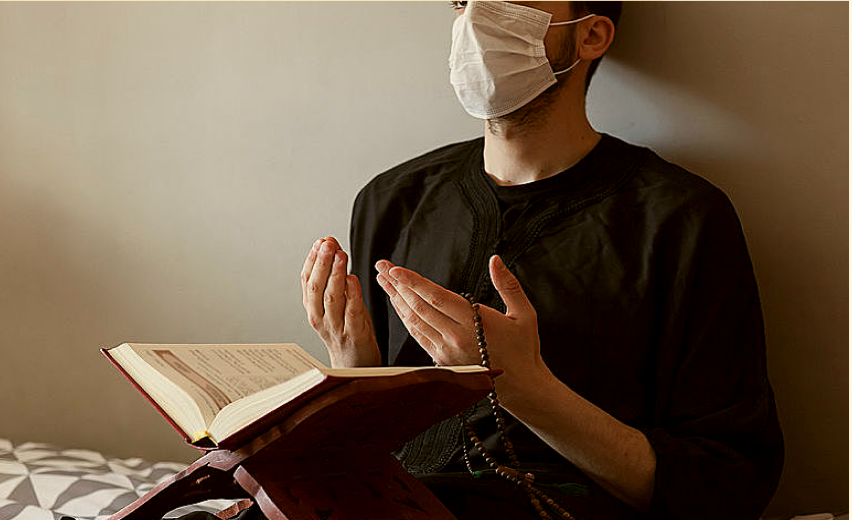

Transform faith into action to inspire the world's most impoverished.

Harnessing the power of Muslim Ummah to help the most impoverished.

In 24 countries, United Muslims works alongside men, women, and children who strive every day to free themselves from poverty, thirst, exploitation and conflict. We collaborate globally to bring relief to the neediest in the form of food, clean water, and shelter, and aim to empower Muslims around the world with quality education, livelihood opportunities and better mental health.

Clean Water

Providing clean water globally, transforming lives locally.

Sponsor a Child

Supporting orphans worldwide with compassionate care.

Education

Educating minds, shaping futures, empowering communities.

Mindful Ummah

Immediate help in crises, offering hope and support.

EMPOWERING Muslims with equal opportunity to succeed in life.

How United Muslims Works

We are a public charity fuelled by the generosity of our donors and supporters. We take pride in implementing 100% donation policy across the board, ensuring every penny donated is spent directly to bring relief to the neediest.

WHAT WE FOCUS ON

Our Programs

Emergency Appeal Programs

Helping those in dire need with immediate assistance, resources, and hope in times of crisis.

Fight Poverty

Programs

Combating poverty by offering essential resources, child sponsorship, and access to quality education.

Mental Health

Programs

Providing support and resources through programs dedicated to enhancing mental health and wellness

We need your help

Featured Campaigns

Discover our initiatives and programs that are successfully helping communities around the world.

Palestine Emergency

More than 33,000 lives lost and 1.7 million crammed into a space equivalent to one-quarter the size of London, lacking food, water, and basic healthcare. Donate for Palestine and support our team in delivering food, water, medical assistance and other essential winter kits to families who have been displaced.

Afghanistan Emergency

Severe drought, economic downturn, and escalating global food costs have driven millions in Afghanistan to the edge of starvation. Lives are in jeopardy, particularly as children suffer and perish from malnutrition. Your support is crucial to aid civilians, who have endured more than five decades of strife.

Syria Emergency

Join us in aiding the world's most extensive population of forcibly displaced individuals, where 90% live in poverty. Many lack access to essential necessities like food, shelter, or even soap. We urge you to contribute and provide crucial assistance, with your donation having the power to transform lives.

Clean Water

Providing wells, pumps, and pipes to communities in need. The lack of clean water is one of the most critical health emergencies affecting Muslim communities globally. Become a monthly donor and embark on a transformative journey to make a significant difference.

Sponsor a Child

Every child should have an ideal beginning: a nurturing environment, a secure space to play, and opportunities for education and healthcare. With immense rewards promised to Muslims who sponsor children/orphans in need. Be the change with United Muslims children response appeal.

Education

Literacy, Numeracy & Health Classes. Millions of children trapped in poverty miss out on education, perpetuating a cycle of limited income opportunities. Breaking this cycle through basic education unlocks numerous life opportunities. At United Muslims, we are the charity for education.

Winterisation

Harsh winters with snow, cold winds, heavy rains, and freezing temperatures make life difficult. United Muslims' winter campaign aids families globally, including refugees and homeless, during these tough months. This initiative provides essential warmth and shelter, ensuring safety and comfort.

Helping USA

United Muslims believes in the principle of charity beginning at home. We're committed to aiding UK families with necessary resources for success. We confront daily challenges like racial inequity, homelessness and poverty. Current surges in inflation, with escalating food and petrol prices, further strain these families, intensifying their hardship.

Mindful Ummah Helpline

Embrace a journey of spiritual healing and communal solidarity. Discover compassionate counselling tailored to your unique challenges and cultural context. Support us in advancing Islam, tackling poverty and financial hardship and promoting social inclusion.

Who we are

Make a Difference

100% Donation Policy

You contributions directly support those in need, not overhead costs, maximising your donations.

Tax Deductible

As a 501(c)(3), your donations to us are tax-deductible, lowering your taxable income and overall tax liability.

Empowering

Spreading compassion in over 24 nations, we aim to end peoples’ dependency on aid.

Transparency & Trust

We maintain a clear policy regarding how donations are used, building trust and accountability.

RELIGIOUS DUES

Give Zakat, Sadaqa, Fidya, and Lillah.

COUNTRIES

Committed to Muslims

United Muslims is committed to serving the needs and interests of Muslim communities, both locally and globally. Below are some of the countries we operate in.

Become a volunteer